So, in the case of an economic downturn, their earnings may plummet because of their high fixed costs and low sales. Managers need to monitor DOL to adjust the firm’s pricing structure towards higher sales volumes as a small decrease in sales can lead to a dramatic decrease in profits. It is important to understand the concept of the DOL formula because it helps a company appreciate the effects of operating leverage on the probable earnings of the company. It is a key ratio for a company to determine a suitable level of operating leverage to secure the maximum benefit out of a company’s operating income. More importantly, it can help companies assess their cost structure and current business models. Therefore, the company can make changes to increase operating profits accordingly.

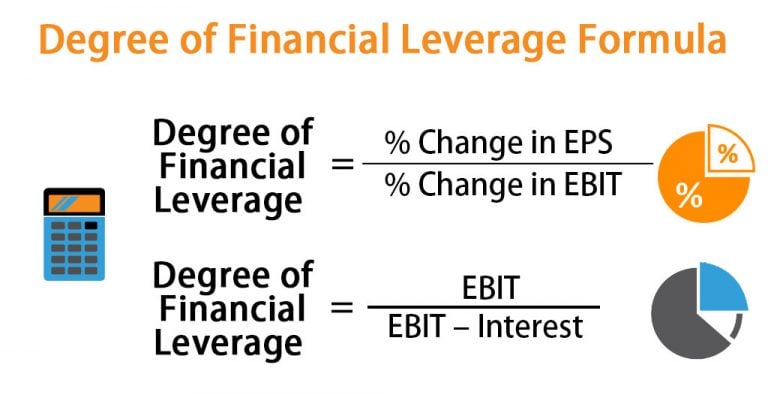

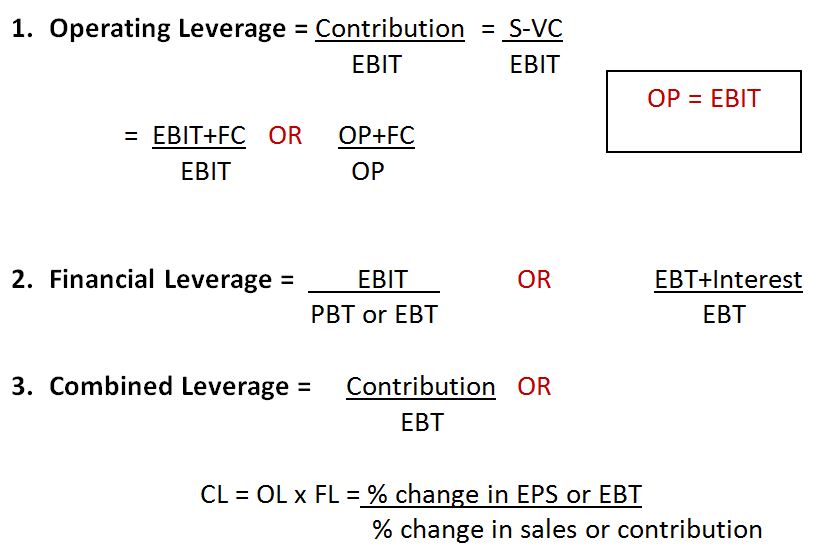

Operating Leverage Formula

High DOL indicates that a small percentage change in sales can lead to a significant change in operating income. A low DOL, on the other hand, suggests that a company’s variable costs are higher than its fixed costs. This means that changes in sales have a less dramatic impact on operating income. Companies with low operating leverage experience smaller fluctuations in EBIT with changes in sales.

Do you own a business?

The more profit a company can squeeze out of the same amount of fixed assets, the higher its operating leverage. Most of a company’s costs are fixed costs that recur each month, such as rent, regardless of sales volume. As long as a business earns a substantial what is the difference between deferred revenue and unearned revenue profit on each sale and sustains adequate sales volume, fixed costs are covered, and profits are earned. The formula can reveal how well a company uses its fixed-cost items, such as its warehouse, machinery, and equipment, to generate profits.

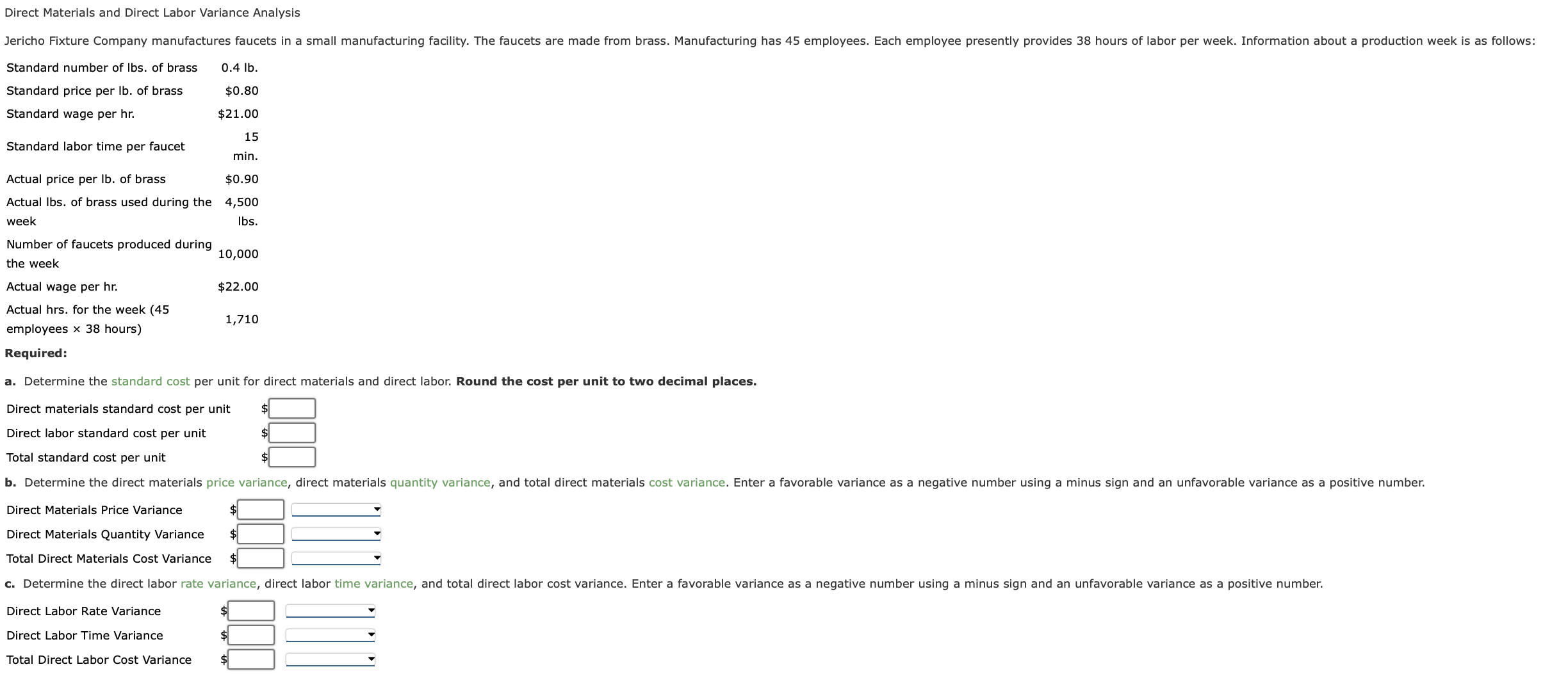

How to Calculate DOL?

DOL helps investors assess the potential risks and rewards of a company’s cost structure, giving insights into how changes in sales might impact profitability. Consider a company with fixed costs of $500,000, variable costs of $2 per unit, and selling price of $10 per unit. The company’s overall cost structure is such that the fixed cost is $100,000, while the variable cost is $25 per piece.

- If a company has low operating leverage (i.e., greater variable costs), each additional dollar of revenue can potentially generate less profit as costs increase in proportion to the increased revenue.

- For example, in a company with high DOL, a 10% increase in sales could lead to a more than 10% increase in EBIT, magnifying the impact on profitability.

- John’s fixed costs are $780,000, which goes towards developers’ salaries and the cost per unit is $0.08.

- A higher DOL indicates a higher risk but also a higher potential for profit growth with increased sales.

- If you try different combinations of EBIT values and sales on our smart degree of operating leverage calculator, you will find out that several messages are displayed.

If sales were to outperform expectations, the margin expansion (i.e., the increase in margins) would be minimal because the variable costs also would have increased (i.e. the consulting firm may have needed to hire more consultants). The degree of operating leverage (DOL) measures how much change in income we can expect as a response to a change in sales. In other words, the numerical value of this ratio shows how susceptible the company’s earnings before interest and taxes are to its sales. For example, in a company with high DOL, a 10% increase in sales could lead to a more than 10% increase in EBIT, magnifying the impact on profitability. This leverage can be advantageous during periods of rising sales but poses higher risks during downturns. However, companies that need to spend a lot of money on property, plant, machinery, and distribution channels, cannot easily control consumer demand.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. An example of a company with a high DOL would be a telecom company that has completed a build-out of its network infrastructure. The catch behind having a higher DOL is that for the company to receive positive benefits, its revenue must be recurring and non-cyclical.

This is the financial use of the ratio, but it can be extended to managerial decision-making. Operating leverage measures how a company’s fixed costs affect its profitability as sales volume changes. In simpler terms, it tells you how sensitive your operating income (or EBIT—Earnings Before Interest and Taxes) is to changes in sales. The more operating leverage a company has, the more its profits will rise (or fall) with changes in sales volume. Companies with high fixed costs tend to have high operating leverage, such as those with a great deal of research & development and marketing.

Here’s your step-by-step guide to using the Degree of Operating Leverage Calculator. We will need to get the EBIT and the USD sales for the two consecutive periods we want to analyze. For the particular case of the financial one, our handy return of invested capital calculator can measure its influence on the business returns. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

To elaborate, it measures how much a company’s operating income will change in response to a change that’s particular to sales. Scenario planning becomes more straightforward with the DOL calculator at your disposal. Assess different scenarios by adjusting sales volumes and costs to see how your operating income would be impacted. After calculating the leverage by applying the formula, if the result is equal to 1, then the operating leverage indicates that there are no fixed costs, and the total cost is variable in nature. The enterprise invests in fixed assets aiming for the volume to produce revenues that cover all fixed and variable costs.

Revenue and variable costs are both impacted by the change in units sold since all three metrics are correlated. Therefore, each marginal unit is sold at a lesser cost, creating the potential for greater profitability since fixed costs such as rent and utilities remain the same regardless of output. The more fixed costs there are, the more sales a company must generate in order to reach its break-even point, which is when a company’s revenue is equivalent to the sum of its total costs. The company usually provides those values on the quarterly and yearly earnings calls. Basically, you can just put the indicated percentage in our degree of operating leverage calculator, even while the presenter is still talking, and voilà.

As a result, companies with high DOL and in a cyclical industry are required to hold more cash on hand in anticipation of a potential shortfall in liquidity. When a company’s revenue increases, having a high degree of leverage tends to be beneficial to its profit margins and FCFs. Suppose the operating income (EBIT) of a company grew from 10k to 15k (50% increase) and revenue grew from 20k to 25k (25% increase).