In other words, greater fixed expenses result in a higher leverage ratio, which, when sales rise, results in higher profits. Operating income is, however, equal to the difference between revenue and total operating costs (variable and fixed costs). Operating leverage occurs when a company has fixed costs that must be met regardless of sales volume.

Degree of Total Leverage (DTL)

Such a company will enjoy huge changes in profits with a relatively smaller increase in sales. On the other hand, if a company has low operating leverage, then it means that variable costs contribute a large proportion of its overall cost structure. Such a company does not need to increase sales per se to cover its lower fixed costs, but it earns a smaller profit on each incremental sale. Companies with high fixed costs tend to have high operating leverage, such as those with a great deal of research & development and marketing. With each dollar in sales earned beyond the break-even point, the company makes a profit. Conversely, retail stores tend to have low fixed costs and large variable costs, especially for merchandise.

DOL, DFL and DTL

A high DOL indicates that a company has a larger proportion of fixed costs compared to variable costs. This suggests that the company’s earnings before interest and taxes (EBIT) are highly sensitive to changes in sales. When sales increase, a company with high operating leverage can see significant boosts in operating income due to the fixed nature of its costs. Conversely, if sales decline, the company still needs to cover substantial fixed costs, which can significantly hurt profitability. If fixed costs are high, a company will find it difficult to manage short-term revenue fluctuation, because expenses are incurred regardless of sales levels. This increases risk and typically creates a lack of flexibility that hurts the bottom line.

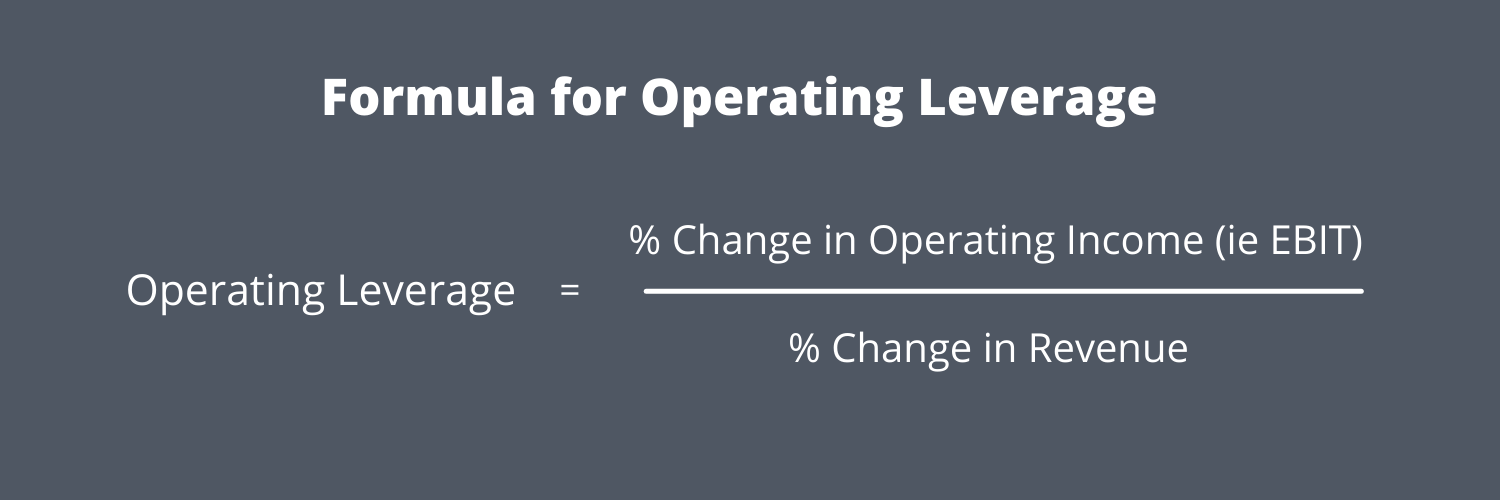

Formula and Calculation of Degree of Operating Leverage

This results in variable consultant wages and low fixed operating costs. As the cost accountant in charge of setting product pricing, you are analyzing ABC Company’s fixed and variable costs and want to look at the degree of operating leverage. ABC sells 500,000 units of its primary product at a sales price of $25.

A high DOL indicates that a company has a higher proportion of fixed costs, leading to greater sensitivity in operating income to changes in sales. To lower your DOL, consider reducing fixed costs, increasing variable costs, or adjusting your cost structure to make it more flexible in response to sales changes. The company’s overall cost structure is such that the fixed cost is $100,000, while the variable cost is $25 per piece. Companies with a low DOL have a higher proportion of variable costs that depend on the number of unit sales for the specific period while having fewer fixed costs each month.

How Can Degree Of Operating Leverage Impact A Business

Let us take the example of Company A, which has clocked sales of $800,000 in year one, which further increased to $1,000,000 in year two. In year one, the operating expenses stood at $450,000, while in year two, the same went up to $550,000. The operating margin in the base case is 50%, as calculated earlier, and the benefits of high DOL can be seen in the upside case. Since 10mm units of the product were sold at a $25.00 per unit price, revenue comes out to $250mm. A company with a high DOL coupled with a large amount of debt in its capital structure and cyclical sales could result in a disastrous outcome if the economy were to enter a recessionary environment. A second approach to calculating DOL involves dividing the % contribution margin by the % operating margin.

Additionally, it does not consider the impact of external factors like market conditions and economic changes. Later on, the vast majority of expenses are going to be maintenance-related (i.e., replacements and minor updates) because the core infrastructure has already been set up. The shared characteristic of low DOL industries is that spending is tied to demand, and there are more potential cost-cutting opportunities. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas.

An operating leverage under 1 means that a company pays more in variable costs than it earns from each sale. In other words, every additional product sold costs the business money. Companies facing this will need to raise prices or work to reduce variable costs to bring operating leverage above 1. Companies with sales and use tax high operating leverage can make more money from each additional sale if they don’t have to increase costs to produce more sales. The minute business picks up, fixed assets such as property, plant and equipment (PP&E), as well as existing workers, can do a whole lot more without adding additional expenses.

- Upon multiplying the $2.50 cost per unit by the 10mm units sold, we get $25mm as the variable cost.

- Just like the 1st example we had for a company with high DOL, we can see the benefits of DOL from the margin expansion of 15.8% throughout the forecast period.

- The company’s overall cost structure is such that the fixed cost is $100,000, while the variable cost is $25 per piece.

In most cases, you will have the percentage change of sales and EBIT directly. The company usually provides those values on the quarterly and yearly earnings calls. Basically, you can just put the indicated percentage in our degree of operating leverage calculator, even while the presenter is still talking, and voilà. A financial ratio measures the sensitivity of a firm’s EBIT or operating income to its revenues. A high DOL can be good if a company is expecting an increase in sales, as it will lead to a corresponding operating income increase. However, a high DOL can be bad if a company is expecting a decrease in sales, as it will lead to a corresponding decrease in operating income.

This means that for a 10% increase in revenue, there was a corresponding 7.42% decrease in operating income (10% x -0.742). A 10% increase in sales will result in a 30% increase in operating income. A 20% increase in sales will result in a 60% increase in operating income. Consequently it also applies to decreases, e.g., a 15% decrease in sales would result to a 45% decrease in operating income. Looking back at a company’s income statements, investors can calculate changes in operating profit and sales.